Copyright : Re-publication of this article is authorised only in the following circumstances; the writer and Africa Legal are both recognised as the author and the website address www.africa-legal.com and original article link are back linked. Re-publication without both must be preauthorised by contacting editor@africa-legal.com

Beacon of hope for African nations?

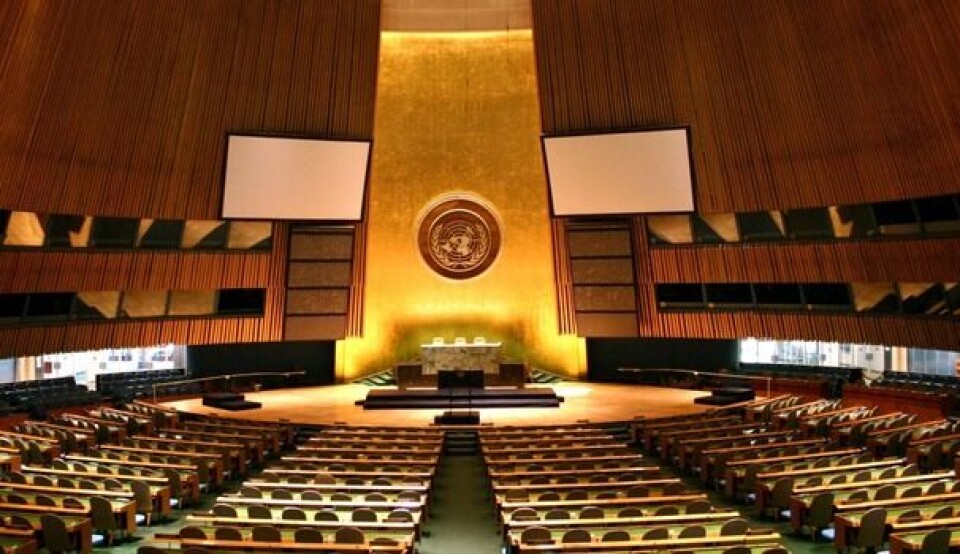

The United Nations’ recent vote to adopt a Convention on International Tax Cooperation is a milestone for the African Group and potentially paves the way for a more equitable and effective global tax system, writes Pelumi Abdul.

On 22 November the United Nations (UN) passed a resolution to create a framework convention on tax. The resolution titled “Promotion of inclusive and effective international tax cooperation at the United Nations”, was tabled by the African Group before the UN General Assembly, where 125 member states voted in favour of the tax convention, while 48 nations voted against and nine abstained. The framework convention on tax will be universally applied, thus reducing the Organization for Economic Co-operation and Development’s (OECD) influence on global tax systems.

Commenting on this development, Baston Woodland, a corporate commercial and tax law expert in Nairobi, said, “International tax rules are an important subject for all countries as they keep the global economy intertwined. Therefore, it is important to have a tax convention under the auspices of the UN and not under a group of privileged countries.”

He believes the proposed negotiations of a UN Framework Convention on International Tax Cooperation will ensure that the African continent participates as an equal member on the global stage with regard to tax regulations. “This will safeguard Africa’s tax base by eliminating incidences of tax abuse and base erosion, particularly attributed to some of the OECD tax conventions. For example, the OECD Model Tax Convention on Income and Capital, was intentionally designed to favour an entity’s country of residence, rather than the source country.” He says Africa loses huge tax revenue through “profit shifting” to OECD countries, where the majority of the MNE’s are headquartered, rather than benefiting the source countries where their economic activities thrive."

Musa Kalejaiye, a Nigerian lawyer, commented that, “It is commendable that the United Nations has set the ball rolling for the UN Framework Convention on International Tax Cooperation. This will occasion a significant shift from the OECD platform which has come under heavy criticism for non-inclusion. For African countries, it is exciting that their hope for equity, transparency, and collaboration in global tax administration is coming to fruition. All things being equal, the negotiations will address the issues of equity in the international tax framework, tax evasion, tax avoidance, and illicit financial flows, which are top challenges facing the Global South countries. The interests of African countries are expected to be well protected in line with the African Union’s 2063 Agenda for Sustainable Development.”

“This initiative holds the potential to foster sustainable development and align with the aspirations outlined in the AU Agenda 2063,” commented Gilbert Matete, a Kenyan legal practitioner. “One crucial implication for the African economy is the potential for harmonisation of tax laws across the continent. A unified approach to taxation can streamline business operations, attract foreign investment, and create a more predictable economic environment. Additionally, in the context of the African Continental Free Trade Area Agreement (AfCFTA), harmonised tax laws can facilitate intra-African trade by reducing barriers and promoting a more integrated and efficient market.” He believes the successful implementation will require careful consideration of each country’s unique circumstances, collaboration among nations, and a commitment to balancing the pursuit of revenue with the promotion of economic growth.

To join Africa Legal's mailing list please click here